Mutual funds : are a type of investment that pools the money from many investors and invests it in stocks, bonds, and other securities.

Mutual funds are an investment vehicle that allows people to invest in stocks or bonds without having to worry about picking individual stocks or bonds. This type of investment is popular because it diversifies one’s portfolio, which means if one particular stock or bond goes down, there is still a chance for success with the others. Mutual funds are also known as “mutual” because they are owned by all of the investors that have invested their money into them.

They offer a diversified portfolio of investments to the investor.

The fund manager is responsible for selecting which investments will be made by the fund.

Mutual funds are a type of investment that pools money from many investors to purchase securities, such as stocks, bonds, and other assets.

A mutual fund is a type of investment that pools money from many investors to purchase securities, such as stocks, bonds, and other assets. Mutual funds are managed by professional fund managers who make decisions about which securities to buy and sell in order to meet the objectives for the fund.

Mutual funds are managed by professional fund managers who make decisions about which securities to buy and sell in order to meet the objectives for the fund. The investments are then divided among the shareholders based on their holdings of shares in the mutual fund.

Mutual funds are a type of pooled investment that has been around for decades. The first mutual fund was created in 1924 by Massachusetts Investors Trust.

Mutual funds are a way for investors to invest in a wide range of securities without the hassle of managing them on their own. They offer investors a diversified portfolio without the time or expertise needed to build one themselves.

Mutual Funds can be broadly classified into two categories: open-ended mutual funds and closed-ended mutual funds.

Mutual funds are typically managed by a professional investment company. They have a fund manager who makes decisions about what to buy and sell in order to generate the best returns for the fund’s shareholders.

Mutual funds offer investors many benefits over other types of investments, including diversification, professional management, and low-cost access to professionally managed investments for those who cannot afford to pay an advisor.

Mutual funds, also called mutual fund companies, are investment companies that invest money from many investors into stocks, bonds, and other securities.

The first mutual fund was established in 1924 by the Massachusetts Investors Trust. It was created by Edward C. Johnson Jr., president of what is now Fidelity Investments.

Mutual Funds are investment vehicles that pool the money of many investors to purchase securities such as stocks, bonds, and money market instruments.

A mutual fund is an investment vehicle where investors pool their money together to purchase securities such as stocks, bonds, and money market instruments. A mutual fund’s performance is based on the overall performance of the underlying investments.

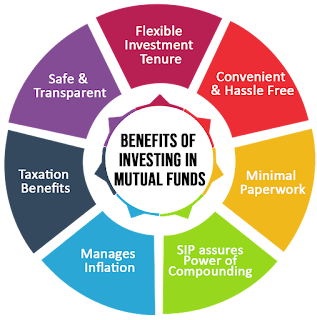

The benefits of mutual fund :

Mutual funds are attractive because they offer an easy way for investors to diversify their portfolios without having to spend time researching or managing different investments. They also come with lower minimums for investing than other types of investments like stocks or bonds, which means that they can be a good option for people who don’t have much money but want to start investing.

The benefits of mutual fund include:

– Professional management

– Lower minimums

– Diversification.